A stalwart in market research, Mcdonald's started in 1940. Brothers Richard and Maurice McDonald kicked it off in San Bernardino, California.

A stalwart in market research, Mcdonald's started in 1940. Brothers Richard and Maurice McDonald kicked it off in San Bernardino, California.

They initially operated a barbecue restaurant. In 1948 they reorganized their business as a hamburger stand (well, in hindsight, a smart move).

They started using the now-famous "speedy" service system. The business model featured a simple menu, high volume, and low prices. And it kicked some serious butt!

They started using the now-famous "speedy" service system. The business model featured a simple menu, high volume, and low prices. And it kicked some serious butt!

Ray Kroc, a milkshake machine salesman, joined the company as a franchise agent in 1954. He bought the chain from the McDonald brothers in 1961 (now a rich man).

Ray Kroc, a milkshake machine salesman, joined the company as a franchise agent in 1954. He bought the chain from the McDonald brothers in 1961 (now a rich man).

Under Kroc's leadership, McDonald's rapidly expanded to become one of the world's most recognizable and successful fast-food brands (and part of many's kid's heritage).

Market research has been one of the reasons for McDonald's ongoing growth.

- The company conducts surveys in its stores and on its mobile app.

- McDonald's does this to learn how diners feel about the food and or delivery service.

- The company has things like teams keeping track of digital channels to "listen" to customers (well, they haven't been listening to me, that's for sure, not a fan).

You learning how you can do market research helps you drive continuous improvement. It's not a one-time exercise. Your market is constantly changing!

You learning how you can do market research helps you drive continuous improvement. It's not a one-time exercise. Your market is constantly changing!

Market research for your online marketplace can also give you the ability to predict future marketplace trends (what people are looking for).

Market research for your online marketplace can also give you the ability to predict future marketplace trends (what people are looking for).

Procter & Gamble (P&G) is a multinational consumer goods company that produces a wide range of products, including personal care, cleaning, and laundry items. The company has a long history of conducting market research!

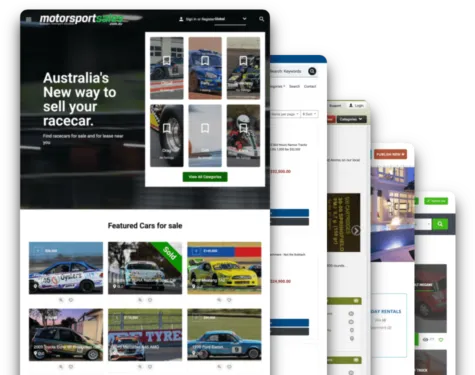

Create Your Own Marketplace Fast

- Launch your own marketplace niche fast

- Easily connect your own domain name

- Create your own categories quickly

- Create custom fields specific to your requirements

P&G's approach includes market research through:

- Surveys

- Interviews and focus groups

- Observational research

You can do similar for your online marketplace.

Do Market Research for Your Online Marketplace by Hosting Focus Groups

So, why did the focus group go into therapy? Because they were tired of being used as a sounding board for bad ideas (insert bad laugh). OK, that was bad, real bad. No more jokes.

So, why did the focus group go into therapy? Because they were tired of being used as a sounding board for bad ideas (insert bad laugh). OK, that was bad, real bad. No more jokes.

But seriously, one way to do market research for your online marketplace is through focus groups.

Focused groups are used to improve existing services through direct feedback.

Focus groups are an effective way for online marketplaces to understand how users perceive their platforms and/or test new concepts in the market.

Focus groups are an effective way for online marketplaces to understand how users perceive their platforms and/or test new concepts in the market.

Conducting a focus group may also be helpful for your online marketplace to reach a broader audience and interact with a younger segment of your market.

Focus groups are also efficient in terms of time; they allow you to observe reactions instead of just hearing opinions.

Focus groups are also efficient in terms of time; they allow you to observe reactions instead of just hearing opinions.

Navigating focus groups is like mapping out a treasure hunt. Each piece of data is a clue that leads you closer to uncovering valuable insights. Ultimately understanding the landscape.

Navigating focus groups is like mapping out a treasure hunt. Each piece of data is a clue that leads you closer to uncovering valuable insights. Ultimately understanding the landscape.

Focus groups are also big business:

- $809 million out of the $2.2 billion spent on conducting focus group research globally in 2017 came from the United States

- $6,000 or more is the cost of professionally managed focus group research, according to Dino Insights

When hosting a focus group, note:

- 6-10 people are the average size of participants in a typical focus group

- 90 minutes is the maximum length of focus group discussions (Faculty Focus)

- 8-12 questions is the number of questions asked (Eliot & Associates)

Amazon is an excellent example of an online marketplace that uses focus groups for market research.

Amazon is an excellent example of an online marketplace that uses focus groups for market research.

Amazon is an excellent example of an online marketplace that uses focus groups for market research.

Amazon conducted focus groups to understand customer needs better. The focus groups revealed that customers wanted:

- More product information

- Better customer service

- More product variety

Amazon used this information to develop new features:

Amazon used this information to develop new features:

- Product reviews

- Customer service chatbots

- Product recommendations

Yes, it works!

To start a focus group, do the following:

- Clearly define the questions

- Recruit a representative sample of the target market

- Use a trained facilitator to ensure that the discussion is unbiased

- Incorporate the findings in the new online marketplace strategy

Use Competitor Analysis to Outpace Your Online Competitors

Competitor analysis is a process of evaluating your competitors' strengths and weaknesses. You can gain a competitive advantage. Ongoing competitor/competitive analysis is essential not to let the competition creep up on you!

Competitor analysis is a process of evaluating your competitors' strengths and weaknesses. You can gain a competitive advantage. Ongoing competitor/competitive analysis is essential not to let the competition creep up on you!

Competitor analysis also helps you identify opportunities in your market by understanding the strategies and tactics working for other businesses.

By understanding the strengths and weaknesses of your competitors, you can:

- Develop strategies to improve your products

- Develop new services

- Devise new link building marketing campaigns

Additionally, good competitor analysis can help you identify the following:

- Potential partnerships

- Acquire complementary businesses

- Develop services to fill unmet customer needs

Or some might compare competitor analysis to a marathon runner studying the competition before a race. Just like a runner analyzes their competitors' strengths and weaknesses, you study your competitors' strengths and weaknesses.

Or some might compare competitor analysis to a marathon runner studying the competition before a race. Just like a runner analyzes their competitors' strengths and weaknesses, you study your competitors' strengths and weaknesses.

With the information, you develop a strategy for the race:

- How to pace yourself

- How to keep an eye on specific competitors

- How to anticipate changes in the race, such as a runner falling back or advancing

Just like a runner who has their proper "competitor analysis," the more you prepare, the more competitive you'll be!

Executives are always worried about competitors:

Executives are always worried about competitors:

- 57% of companies report that achieving a competitive edge is among their top priorities (Forbes).

- 53% of CEOs said that they are worried about competition from disruptive companies

And competitive analysis is highly valued in organizations:

- 56% of executives use competitive intelligence to monitor their potential competitors (18th Annual Global CEO Survey)

- 74% of a recent Conductor study respondents agreed that competitive analysis is important or very important.

One of the most well-known online marketplaces, eBay, is an example of how competitive research can transform a company's future.

One of the most well-known online marketplaces, eBay, is an example of how competitive research can transform a company's future.

One of the most well-known online marketplaces, eBay, is an example of how competitive research can transform a company's future.

By leveraging competitive research in 2003, eBay shifted the site's focus from auctions to a multinational marketplace. This change allowed the marketplace to increase its reach and better serve customers with a broader range of offerings.

An online marketplace that wants to leverage market research through competitor analysis can do the following action steps:

- Identify your competitors

- Analyze their offerings to understand their strengths and weaknesses

- Analyze your competitors' marketing strategies

- Identify opportunities to improve your offerings or fill market gaps

Use Social Media to Conduct Market Research

Social listening is like being a fly on the wall at a fancy cocktail party. You get to observe all the juicy gossip and conversations without anyone knowing you're there.

Social listening is like being a fly on the wall at a fancy cocktail party. You get to observe all the juicy gossip and conversations without anyone knowing you're there.

Except in this case, the party is on social media, the guests are internet strangers, and the gossip is about brands and products!

It's like a virtual reality soap opera; you're the star detective trying to figure out what everyone is thinking about you.

It's like a virtual reality soap opera; you're the star detective trying to figure out what everyone is thinking about you.

Social listening can provide valuable insights into customer needs, preferences, and pain points! Social listening research can also provide an understanding of customer sentiment.

Social listening is a powerful indicator of overall customer satisfaction. It identifies customer pain points or areas of dissatisfaction.

Social listening is a powerful indicator of overall customer satisfaction. It identifies customer pain points or areas of dissatisfaction.

Additionally, by tracking mentions of your competitor on social media, you can see how you are performing in comparison. Identify areas where you might be able to improve your offerings.

You conducting market research through social listening could be compared to a "sponge" that absorbs information from the surrounding "ocean" of social media conversations.

You conducting market research through social listening could be compared to a "sponge" that absorbs information from the surrounding "ocean" of social media conversations.

Just as a sponge absorbs water, you absorb valuable social media insights to inform your business decisions and strategies. Yes, exactly!

Who uses social listening tools?

- 80% of survey participants utilize multiple social listening tools (The Social Intelligence Lab)

- 61% of companies currently have a system in place for monitoring (Social Media Today).

- 82% of companies consider social listening an essential component of their planning process.

- 54% of social browsers reported that they utilize social media to research products, according to (Global Web Index).

- 51% of marketers worldwide say they use social listening to understand changing consumer preferences during the pandemic, according to (Intelligence article)

Etsy is an online marketplace for handmade and vintage goods, and they also use social listening to gather market research.

By monitoring customer conversations on social media, Etsy identified trends in consumer preferences and tailored its offerings to meet those needs.

They also use social listening to track customer feedback and respond to real-time complaints and questions.

Dell did similarly.

Dell did similarly.

The company's Social Media Listening Command Center, launched in 2009, tracks and analyzes conversations about Dell on social media platforms. This allows Dell to identify customer complaints and issues.

By using social listening, Dell was able to identify a trend of customers complaining about long wait times! Specifically to their customer service hotline.

By using social listening, Dell was able to identify a trend of customers complaining about long wait times! Specifically to their customer service hotline.

In response, Dell implemented a new system that allows customers to track the status of their customer service requests. They can receive updates via social media.

Dell also uses social listening to gather insights about customer preferences and interests. Social listening also informs product development and marketing strategies.

Dell's use of social listening has been widely recognized as a best practice in the industry. The company has won several awards for its social media efforts!

Want to start social listening?

- Sign up for tools Hootsuite, Brand24, and Mention to track brand mentions

- Analyze the mentions of your brand and products

- Look for any customer pain points or areas of dissatisfaction

- Look for issues with product quality, shipping times, or customer

- If you come across customer complaints on social media, respond promptly

- Acknowledge the customer's concern and do your best to resolve the issue

Summary

Market research is essential for any online marketplace! You can use various methods for market research, including focus groups, competitor analysis, and social listening.

- Focus groups allow for in-depth discussions with small groups

- Competitor analysis allows for an understanding of how you are performing

- Social listening provides tracking mentions of the online marketplace

By combining these methods, you'll better understand your customers and make more informed decisions.

- What other methods can online marketplace use to conduct market research?

- Have you participated in a focus group?

- How do you feel about surveys?